Overbought and oversold in Forex trading

Содержание статьи:

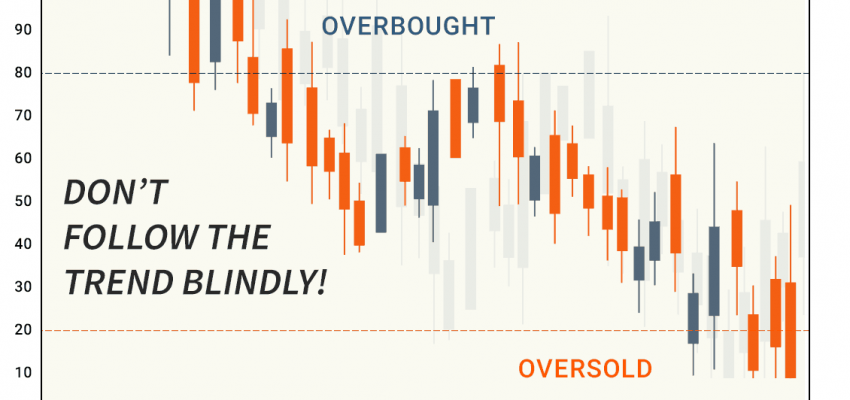

Many new traders believe that all they have to do when trading Forex is buy in an uptrend and sell in a downtrend .

While this is common knowledge, there are many other factors, such as overbought and oversold conditions, that determine whether a trade is profitable or not.

Have you ever asked yourself the following questions

- How do you know if the price of a currency is too high to open a long position?

- How do you know if the price of a currency is too low to open a short position?

- You may decide to buy on a clear and obvious uptrend, but are you sure the price won’t reverse anytime soon?

Overbought and oversold

Today we will look at what an overbought or oversold condition means for a currency pair.

If the pair is moving in an uptrend, it may reach a point where there will be no more buyers in the market .

At this point, the currency is considered overbought and the trend is likely to reverse. The same is true for a downtrend.

A currency is considered oversold when the price is too low and there are no sellers left in the market . This could potentially lead to the start of an uptrend.

The main thing to remember here is that the price of a currency cannot always move in one direction. At some point, the price should definitely change its direction.

This change in direction can occur for many reasons. One of the most important reasons is overbought or oversold prices.

A currency pair that is either overbought or oversold is likely to reverse.

But this is not always the case. The pair can also be oversold or overbought for a long time.

To determine if a price reversal will actually occur, we can use oscillators.

Frequently used indicators to determine these conditions

Two popular indicators help traders to determine overbought and oversold conditions

- Relative Strength Index (RSI).

- Stochastic Oscillator.

The RSI is a range-pegged oscillator with a scale from 0 to 100. When the RSI value rises above 70, it indicates an overbought situation.

If the reading is below 30, it indicates an oversold situation. Traders take short positions when the RSI is above 70 and long when it is below 30.

For best results, RSI is also used in combination with other indicators.

The Stochastic is a simple momentum oscillator that also helps you find overbought and oversold conditions.

The Stochastic also has a scale from 0 to 100. A reading above 80 indicates that the pair is overbought, while a reading below 20 indicates that it is oversold.

While both RSI and Stochastic can determine oversold and overbought levels, they have some differences in terms of basic theories and methods.

Generally, RSI is more useful in trending markets, while Stochastic is best used in markets with sideways and choppy price action.

How to get the most profit

Using overbought and oversold conditions also goes a long way in getting the most out of a trade.

If you buy exactly during the reversal of a downtrend, you will make the most of the uptrend that follows.

Likewise, by placing a sell order right at the start of a downtrend, you are more likely to get the most out of that trade.

Based on overbought and oversold conditions, traders can develop their own trading strategies.

A good understanding of how overbought and oversold oscillators work and doing in-depth research can help you develop your strategy.

But if you are looking for a tool that can make your technical analysis job easier, take a look at the Pipbreaker indicator .

It automatically analyzes the market and tells you exactly when to buy or sell.