Why the Forex market is called ‘interbank’ is very simple – as initially, there was no one on it except for banks.

Forex was originally conceived as a means for the development of commerce and trade between states. The American company buys spare parts, for example, in Japan. Accordingly, the company needs yen. And if it is a very large company, then you need a lot of yen. Where can I get them? Buy through a bank. Where will the bank take them? He buys from colleagues through Forex and sells to the company at a slightly less favorable rate – he will take the spread for his services.

If you go to the bank to exchange dollars or rubles for some other currency, you will see that the rates are fixed. They do not change throughout the day.

Thanks to a deeper understanding of the market, the bank can fix quotes: take an obligation to conduct an operation at the current rate, in other words, hedge until a client appears on the market who is ready to buy at a given price. This process allowed banks to significantly increase their net profit. The unfortunate consequences were that liquidity could be redistributed in such a way that sometimes it was not possible to complete certain financial transactions.

It is for this reason, and for this reason alone, that the market eventually had to be opened to non-bank participants. Banks wanted to have more orders on the market; thus, a) they could profit from less experienced participants, and b) less experienced participants could provide a better allocation of liquidity for international business hedge transactions. Initially, only hedge funds with large capital (for example, the Soros fund and others) were allowed to foreign exchange transactions, but after a while retail brokerages and ECNs began to be allowed to foreign exchange transactions.

All Forex is essentially a large and multi-level system of electronic orders for the purchase and sale of currency. The prices you see are just the best deals from the liquidity providers.

Why does the FX market remain so weakly regulated? One of the reasons is the reluctance of countries to interfere with international trade, which is needed like air for the healthy functioning of the economy.

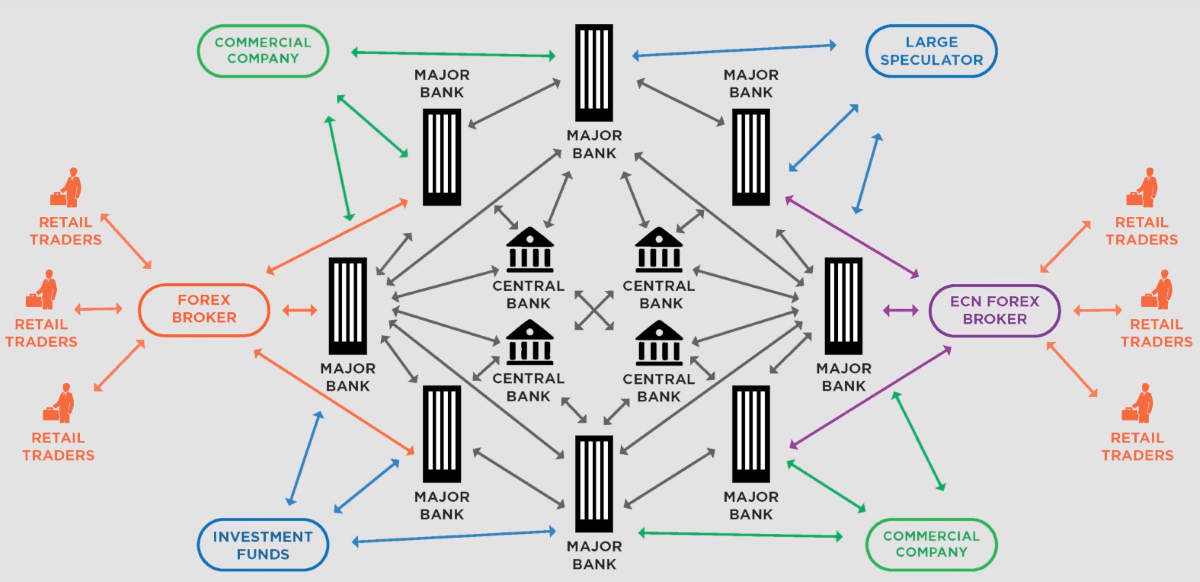

Market participants Participants in the currency market are: Large banks Commercial corporations Central banks Governments Hedge funds Speculators Quotes Primary sources of quotes The Forex market is interbank and the main liquidity on Forex is provided by banks. At the same time, only a few of the world’s largest banks provide retail Forex services. Almost a third of the world’s trade turnover is owned by Citi and Deutsche Bank.

The question of a fair price in the Forex market is very delicate, since in the foreign exchange market there is no concept of a single price, as well as the true value of a currency. Decentralization of the market allows you to make transactions at the same time at different quotes, which are often invisible to other trading participants. The emergence of aggregators (like Integral, Currenex, LMAX, etc.) not only contributed to the development of retail Forex, but also later made this business more transparent.

Forex is a decentralized foreign exchange market, market quotes are generated based on supply and demand and are provided by large market participants (liquidity providers). Each participant offers their own price, the best of them go to the platform. Discrepancy in prices is the norm, since it is impossible to achieve absolute unity in prices in the presence of a large number of counterparties.

Almost always, the rates provided by banks are indicative and do not mean one hundred percent possibility of making transactions at the offered price. The actual value of the contract may depend on many factors, including: client status, order volume, value date, trade delays, etc. At the same time, the execution of your orders can be significantly improved by adding some markup to the transaction price, that is, a deliberate price deterioration. The less competitive prices you offer, the closer to real quotes you get. As a result, trying to trade at the best prices in the Forex market almost always carries the risk of partial execution or rejection (order cancellation).

In fact, all quotes on Forex are indicative, except perhaps for client ECN liquidity. If ECN liquidity grew so much that it could cover the needs of all clients at least within one broker, it would be possible to get rid of the concept of indicative quotes altogether.

Banks and hedge funds exchange quotes through specialized intermediaries in the form of information systems, such as: Reuters, Bloomberg, Tenfor, DBC, etc. At the same time, quotes received from information systems do not mean the fact of a transaction at a particular price, and the result of some real transactions may not get there at all. Liquidity aggregators

Compared to the stock exchange, the Forex market has a much higher turnover and, accordingly, more liquidity. This means that in the foreign exchange market, you can buy or sell a particular currency as quickly as possible, regardless of the volume, time or trading session.

Brokers providing retail Forex services use the services of aggregators, connecting directly to liquidity providers (banks) using a specialized electronic communications protocol (FIX). The task of the aggregators is to unite the largest banks, financial institutions and funds into a single stream of quotes.

There are great advantages to using the services of an aggregator, since it is obvious that it cannot offer prices worse than a separately selected liquidity provider. Therefore, brokers and dealing centers, as a rule, either use the services of large aggregators, or create their own. At the same time, some brokers, for example, can additionally provide their own quotes from transactions with clients within the company, thereby creating some kind of darkpool.

Broker models

Market making

A market maker, as a rule, is a broker or a dealing center that is directly involved in making transactions. Its main task is to maintain bilateral buy and sell orders that meet the requirements for the size of the spread (the difference between the price of a buy order and a sell order) issued by the bank.

Dealing desk brokers are both buyers and sellers. The main income in this case comes from fixed spreads and clients’ trading operations. Such brokers are usually called dealing centers (DC), or, as the people say, kitchens. The orders of DC clients are not displayed on external counterparties and, as a rule, are executed at the expense of counter orders of the broker itself.

In this case, the broker itself is a counterparty and fully monitors and controls all trading operations of its clients. Earning clients play against the broker and, accordingly, bring him a direct loss. Therefore, the activity of market makers implies the use of various schemes for limiting profitability, including delaying trade orders, canceling transactions, etc.

Today, algorithms drive pricing in the marketplace. Obviously, the task of the algorithm used by the market maker is to achieve the maximum difference between the drain and the earnings of his clients. Improving MM algorithms is facilitated by the presence of insider information, since banks know the current positions of their clients and how they have traded in the past. At the same time, you can also become the owner of the MM algorithm. The main task does not change from this – to squeeze out as much money as possible from the merging players.

Toxic stream

Toxic flow (or toxic) in the Forex market is called an unwanted flow of orders, or rather, any trading activity in connection with which a bank or broker begins to lose money. This term is used by market makers and almost 100% of the toxic flow is accounted for by algorithmic traders who make money on the inefficiencies of market maker algorithms.

In this regard, it is not possible to create a clean interbank market. That is why, conducting an honest business on Forex is possible only through masking toxicity in the general flow of trade orders, which is facilitated by the use of modern ECN / STP aggregators. This allows you to create independent dark pools, where client orders can be matched with each other and become invisible to external counterparties.

ECN / STP

Unlike market makers, brokers acting as an intermediary between a client and a counterparty do not trade directly with the company’s clients and do not earn on their losses or profits. They receive their main income from markups and commissions. Further, such brokers are divided into two subspecies: STP (Straight Through Processing) and ECN (Electronic Communications Network) + STP. Completely independent ECN systems do not yet exist.

The main feature of the STP broker is the direct link between the client and the liquidity provider. Typically, the provider is an aggregator, which can include many providers, thereby providing the best prices and increasing liquidity. This type of broker provides a choice between floating or fixed spread. Despite the fact that the main providers of liquidity are large banks that provide a fixed spread, the aggregator has the opportunity to choose the best prices among all offers for sale and purchase. In some cases, this can lead to a zero or even negative spread value.

The addition of the ECN system makes it possible to carry out direct transactions between clients of one company. In fact, the broker in this case provides a platform where banks, market makers and private traders can make transactions with each other directly, which sometimes makes it possible to make transactions at a better price than when using external counterparties. Moreover, this allows you to almost completely get rid of trade delays (latency) and rejections, which, if there is sufficient liquidity, gives almost perfect execution. This is beneficial for the broker as well, since it allows you to take full commission from transactions without sharing with the main provider of liquidity.

A-Book and B-Book orders

“As soon as I started earning, Orders started to execute worse! The broker began to put a spoke in my wheels, Forex is a scam! ” – Such screams can be found on the net. What actually happened? Have brokers tracked your account?

In fact, everything is very simple. Within one broker model (including ECN) there is an automatic distribution: small orders of new and non-earning traders are brought together according to the B-book principle – within the company, they are not displayed anywhere. That allows you to get a noticeably better performance. Large orders and orders of stably profitable traders are executed according to the A-Book – they are displayed on counterparties. What causes execution delays, slippage, etc.

So, if after you start earning, performance has deteriorated, that’s okay. It means that your orders have just become closer to that very “interbank market”.

Conclusions

The Forex market is really huge. It is impossible to say unequivocally whether it is good or bad – you just need to know the nuances and rules of the game in order to emerge from it as a winner.

As for the models of brokers’ work, it is important to understand that the main factor in choosing which model to work with is the profitability of the trading system, and not the nuances of order execution. However, the market maker model has its advantages as it can provide better execution. On the other hand, the ECN / STP model gives the best prices. At the same time, this model is definitely more transparent, and using the markup you can significantly improve the performance.